HMRC Government Gateway Login

The HMRC Government Gateway login is the official and secure way for individuals and businesses in the United Kingdom to access a wide range of online government tax services. Whether you are filing a Self Assessment tax return, managing VAT, running payroll, or checking your tax records, the Government Gateway acts as a single digital access point for HMRC services.

This guide explains everything you need to know about the HMRC Government Gateway in clear, professional English—from logging in and creating an account to fixing common problems and keeping your account secure.

What Is the HMRC Government Gateway?

The Government Gateway is an online authentication system provided by HM Revenue and Customs (HMRC). It allows users to sign in once and securely access multiple UK government services related to tax and compliance.

Instead of creating separate logins for each service, users can manage everything through one Government Gateway account.

Services Available Through Government Gateway

- Self Assessment tax returns

- VAT registration and VAT returns

- PAYE and payroll services for employers

- Corporation Tax filing

- Child Benefit and tax credits

- Making Tax Digital (MTD) services

In simple terms, the Government Gateway is the central hub for managing your UK tax obligations online.

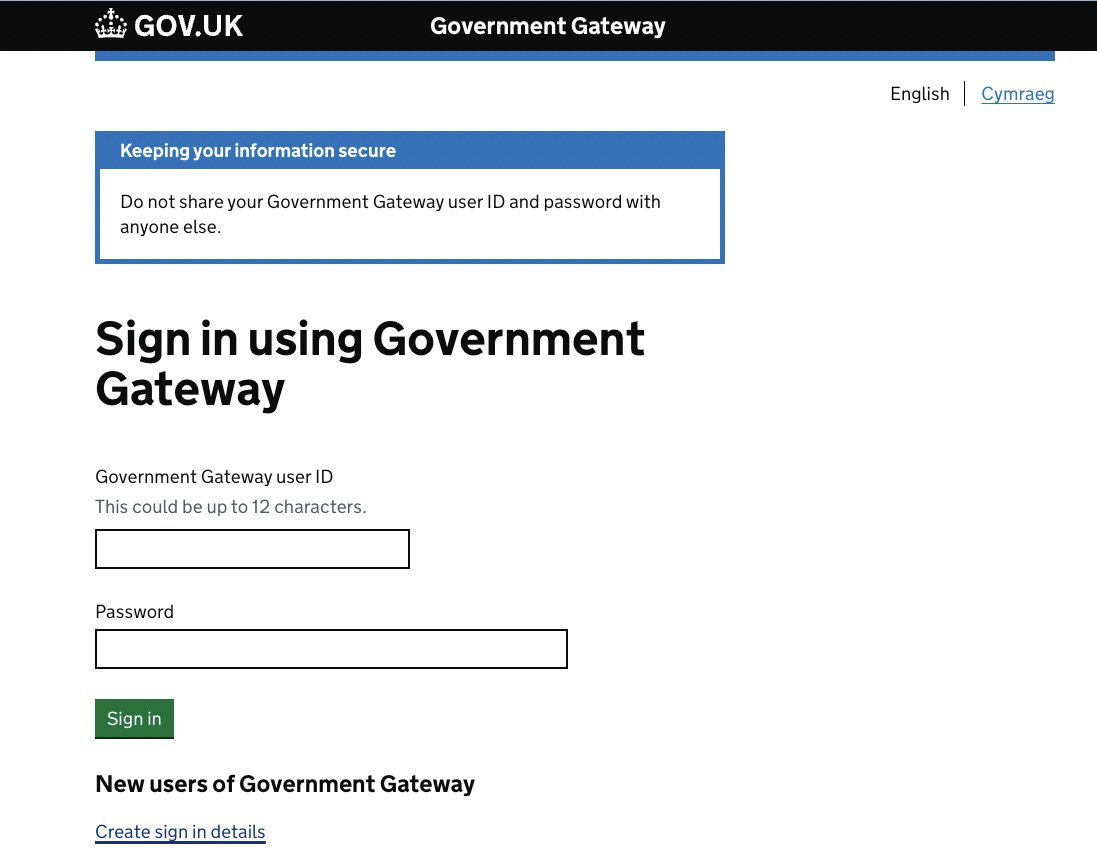

How to Log In to HMRC Government Gateway

Logging in is straightforward if you have your details ready.

Step-by-Step Login Process

- Open the official HMRC Government Gateway sign-in page

- Enter your Government Gateway User ID

- Enter your password

- Complete the two-step verification (a security code sent to your phone or email)

- Access your HMRC dashboard and select the service you need

Once logged in, you can view deadlines, submit returns, make payments, and manage your tax information.

How to Create a Government Gateway Account

If you do not already have an account, you must register before using HMRC online services.

Account Registration Steps

- Choose the option to create sign-in details

- Enter a valid email address and confirm it

- Set a secure password

- Receive your Government Gateway User ID

- Add the HMRC service you need (for example, Self Assessment or VAT)

Important:

Your User ID is issued only once and cannot be changed. It should be saved securely for future use.

Recovering a Forgotten User ID or Password

Many users experience login issues because they forget their credentials. HMRC provides recovery options for both.

Forgot User ID

- Select the “Forgot your user ID” option

- Enter your registered email address

- HMRC will email your User ID to you

Forgot Password

- Click on “Forgot your password”

- Enter your User ID

- Complete the security check

- Create a new password

These recovery steps usually take only a few minutes.

HMRC Government Gateway for Individuals and Businesses

The same login system is used for both personal and business tax services, but the services you access will depend on your role.

Individuals Can:

- File Self Assessment tax returns

- Check tax codes and PAYE details

- View tax payments and refunds

Businesses and Employers Can:

- Submit VAT returns

- Manage PAYE and payroll

- File Corporation Tax

- Comply with Making Tax Digital rules

This flexibility makes the Government Gateway essential for anyone dealing with UK taxes.

Common HMRC Government Gateway Login Problems

Despite being reliable, users sometimes face technical or access issues.

Website Not Loading

- Clear browser cache and cookies

- Try a different browser or device

- Check your internet connection

Security Code Not Received

- Check your spam or junk email folder

- Confirm your registered phone number or email

- Request the code again after a short wait

Account Locked

- Multiple failed login attempts may temporarily lock your account

- Wait a few hours and try again

- Contact HMRC support if the issue continues

Security and Privacy Tips

HMRC uses strong security measures, but users should also follow best practices.

- Never share your User ID or password

- Use a strong, unique password

- Enable two-step verification

- Avoid logging in on public or shared computers

- Always sign out after finishing your session

These steps help protect sensitive financial and personal information.

Can You Use HMRC Government Gateway on Mobile?

Yes. The Government Gateway works on mobile browsers, and HMRC also offers an official app for certain services. Through mobile access, users can:

- Check tax codes

- View PAYE information

- Receive important notifications

However, some advanced services are best accessed on a desktop or laptop for full functionality.

Frequently Asked Questions (FAQs)

Is the Government Gateway free to use?

Yes, registration and use are completely free.

Can one account access multiple HMRC services?

Yes, you can add multiple services to a single Government Gateway account.

Do I need separate accounts for personal and business taxes?

No, the same login can be used, but the services will be listed separately.

Can non-UK residents use the Government Gateway?

If you are liable for UK tax, you may still use HMRC online services.

Conclusion

The HMRC Government Gateway login is a vital tool for managing taxes and compliance in the UK. It simplifies access to essential services, reduces paperwork, and allows individuals and businesses to handle tax matters efficiently and securely online.

By keeping your login details safe and understanding how the system works, you can avoid common issues and make full use of HMRC’s digital services.